Chinese Association of Idaho State University (CAISU)

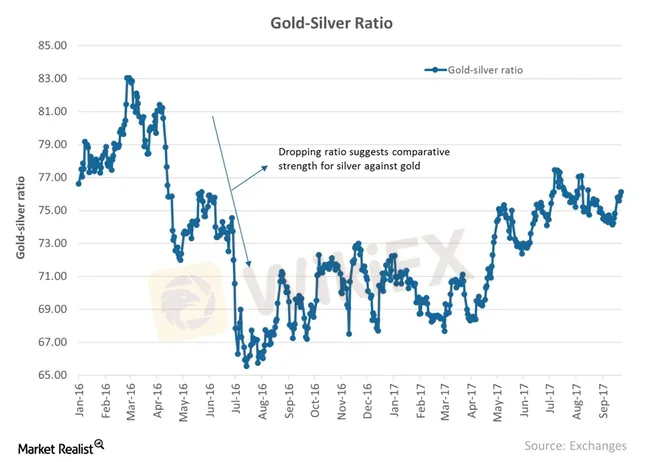

Gold-Silver Ratio once hit a historical high of 112.82 in March 2nd this year. Now its slightly down, hovering around 100, but still at a relatively high level.To get more news about WikiFX, you can visit wikifx official website.

Spot silver dropped an overall 21.59% in the first quarter, with a performance much inferior to spot gold. But spot silver seemed to have its day coming in May, gaining 7.9% in compare to spot golds 3.06% rise. We see at least 3 reasons for silver to outperform gold.

First of all, historical data shows silver is relatively cheaper than gold.

Secondly, silver‘s positions are clearer (less packed than gold’s positions)

Finally, reopening of economy will likely see a rebound of industrial activities, and given that 50% of annual silver output is consumed by the industrial sector, silver consumption is expected to hike.

For speculative purpose, there‘s still plenty of room for silver. CFTC Commitment of Traders report shows that as of the week ending May 5th, investors cut their net long positions in silver by 403 tonnes, with net longs accounting for only 17% of open interests, significantly less than the historical peak of 57%. This suggests that once the market sentiment turns around, there’s plenty of room for additional speculative purchases.

查看次数: 38

评论

您必须是爱达荷州立大学中国学生学者联谊会 的成员才能加评论!

加入 爱达荷州立大学中国学生学者联谊会